John Teets was a visionary leader who built an incredible financial empire through hard work, strategic thinking, and ethical leadership. With a net worth of $50 million, his success as a CEO is a testament to his effective decision making and long term vision. Teets expanded his company influence by making bold moves that not only broadened its market reach but also grew his personal wealth significantly.

One of his standout strategies was diversification, as he invested across multiple sectors, including technology, real estate, and renewable energy. This approach helped secure his financial stability and resilience in the face of changing markets. By focusing on sustainable wealth creation and maintaining a strong reputation for ethical business practices, Teets built wealth while preserving his integrity.

This article explores how John Teets net worth reflects his leadership style, business decisions, and dedication to building a lasting legacy.

Profile Summary

| Category | Details |

| Full Name | John Teets |

| Net Worth | $50 million |

| Profession | CEO, Business Executive, Investor |

| Industry | Business, Real Estate, Technology, Investment |

| Notable Company | Greyhound Corporation |

| Leadership Style | Visionary, Strategic, Risk Taker |

| Key Investments | Technology, Real Estate, Renewable Energy |

| Philanthropy | Active in charitable contributions, supporting various social causes |

| Legacy | Strong influence on business leadership, innovation, and corporate success |

| Key Achievement | Successful corporate restructuring, expanding Greyhound, and growing his wealth |

| Major Contributions | Played a key role in the transformation and growth of several businesses |

| Strategic Decisions | Pioneering in diversifying investments and focusing on high growth industries |

| Economic Impact | Created lasting changes in the business world, with a focus on sustainable wealth creation |

| Personal Investments | Real estate properties, stocks, and emerging market investments |

| Leadership Influence | Teets’ leadership inspired other business executives and shaped modern corporate strategies |

| Notable Recognition | Recognized for his financial acumen and strategic vision in both corporate and investment sectors |

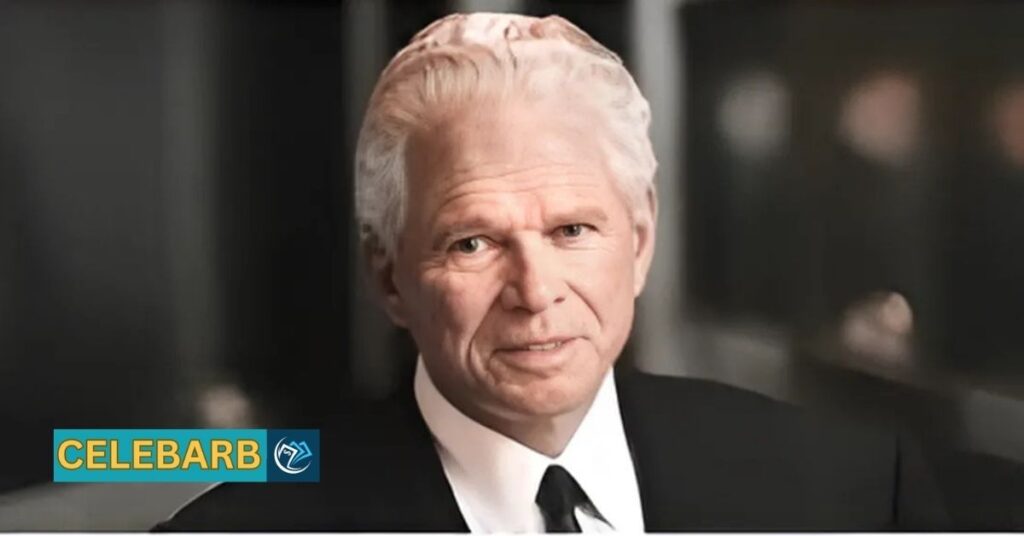

John Teets

John Teets is a prominent American business leader and former CEO, best known for his role in shaping the Greyhound Corporation. He gained recognition for his strategic approach to corporate leadership and innovation, overseeing the company’s growth and diversification.

Teets net worth grew through smart investments, diversification strategies, and corporate restructuring, making him a notable figure in the business world. His journey from a corporate executive to a financial powerhouse has inspired many aspiring leaders and investors.

The Rise to Corporate Leadership

Teets’ journey with Greyhound Corporation began in the early 1980s. When he became CEO in 1982, the company was primarily known for transportation services. Under his visionary leadership, he introduced a diversification strategy that expanded Greyhound into food services, consumer products, and financial services.

This bold move not only ensured market value growth but also secured his reputation as a forward thinking executive.

John Teets Park: A Community Gem in 2025

John Teets Park continues to be a cornerstone of community recreation in 2025. Located in the heart of the city, this park offers a peaceful retreat for families and outdoor enthusiasts. Known for its spacious walking trails, playgrounds, and scenic views, the park has recently undergone significant upgrades, including modern sports facilities and improved accessibility.

As a popular destination for local events and social gatherings, John Teets Park reflects the city’s commitment to enhancing public spaces. Whether for a weekend picnic or a leisurely stroll, the park remains a key part of the community’s vibrant landscape in 2025.

His leadership style emphasized strategic business decisions and the importance of aligning corporate goals with societal needs.

Teets believed in balancing profitability with sustainable wealth creation, making decisions that benefited shareholders while also contributing to broader economic stability.

John Teets Net Worth: Breaking Down the Numbers

As of 2024, John Teets net worth is estimated at $50 million. This valuation is a testament to his ability to capitalize on investment strategies, negotiate lucrative executive compensation, and manage personal investments wisely. During his tenure at Greyhound, he earned a significant salary and performance based bonuses. However, much of his wealth stemmed from stock options that appreciated as the company grew.

Teets also diversified his personal portfolio, investing in real estate investments, technology, and renewable energy. These ventures allowed him to build a financial legacy that extended beyond his corporate career.

His story highlights how strategic investments and careful planning can lead to substantial financial rewards.

Sources of Wealth

Sources of Wealth for John Teets included his CEO role at Greyhound Corporation, smart investments in real estate and tech, and executive compensation. He also expanded wealth through diversification and strategic business ventures.

- Executive Compensation: As CEO of Greyhound Corporation, Teets earned a significant income through a combination of salary, bonuses, and stock options. His executive compensation package reflected his impact on the company’s market value growth.

- Investments: Teets was known for his shrewd investment strategies. He diversified his portfolio across sectors like real estate investments, technology, and renewable energy. This diversification strategy minimized risks and allowed him to capitalize on emerging market trends.

- Business Ventures: Through strategic acquisitions and expansions, Teets grew Greyhound’s operations into food services, consumer products, and other profitable areas. These business ventures significantly boosted his wealth.

- Real Estate: Teets invested heavily in real estate, acquiring valuable properties that appreciated over time. These assets not only provided sustainable wealth creation but also generated consistent passive income.

- Strategic Decisions: His leadership style focused on corporate restructuring and innovative solutions, leading to enhanced revenues and increased company value. These strategic business decisions played a critical role in his financial empire.

- Philanthropy: Teets used philanthropy as a way to support charitable causes and optimize tax benefits. This approach balanced his desire to give back with his goal of wealth management.

Strategic Business Decisions and Their Impact on Net Worth

Teets’ success was largely driven by his strategic business decisions. He restructured Greyhound to focus on high performing sectors while divesting less profitable ones. This corporate restructuring streamlined operations and boosted overall profitability. His emphasis on business diversification reduced the company reliance on a single revenue stream, making it more resilient to market fluctuations.

A hallmark of his leadership was his focus on emerging market trends. For example, he invested heavily in consumer services during a time of growing demand, positioning Greyhound as a leader in multiple industries. These decisions not only increased the company’s market value but also contributed significantly to his personal wealth.

Diversification Strategy

- Portfolio Expansion: John Teets was known for his strong diversification strategy. He spread his investments across multiple industries, reducing risks while maximizing potential returns.

- Sectors of Focus: His diversification included key sectors like technology, energy, real estate, and financial services, allowing him to tap into emerging market trends and stabilize his wealth.

- Risk Mitigation: By not relying on a single market or industry, Teets’ diversification strategy helped shield him from market volatility, ensuring his wealth grew steadily even during economic downturns.

- Strategic Business Decisions: His ability to make sound decisions in different sectors showed his understanding of economic impact and the importance of a balanced, sustainable investment approach.

The diversification strategy broadened the company’s revenue streams and raised its market value, which in turn positively affected Teets’ net worth through his stock ownership and performance linked bonuses.

Corporate Restructuring

- Leadership Vision: John Teets spearheaded corporate restructuring efforts at the Greyhound Corporation, streamlining operations to enhance efficiency and profitability.

- Asset Optimization: He sold underperforming assets and reinvested in high growth areas, focusing on sectors that aligned with emerging market trends and long term sustainability.

- Operational Efficiency: By restructuring departments and cutting unnecessary costs, Teets improved productivity while maintaining ethical business practices and prioritizing sustainable wealth creation.

- Market Value Growth: His strategic approach to corporate restructuring significantly boosted the company’s market value, solidifying his reputation for innovation in leadership and visionary decision making.

These actions, though at times controversial, resulted in higher profitability and greater shareholder value, which boosted Teets personal wealth.

Investment Philosophy and Wealth Management

John Teets built his wealth through a thoughtful investment philosophy that prioritized long term growth over short term gains. He focused on diversification, spreading his investments across various industries, including technology, real estate, and emerging market trends. This approach helped him manage risks and capture opportunities in different sectors.

- Diversified Portfolio: John Teets invested in real estate, technology, and emerging markets for steady growth.

- Long Term Focus: He prioritized sustainable wealth creation over short term gains.

- Wealth Preservation: Teets used conservative strategies to protect assets from market risks.

- Ethical Investments: His choices aligned with emerging market trends and responsible practices.

Teets also emphasized the importance of sustainable wealth creation by making strategic decisions that ensured steady returns. His wealth management strategies balanced conservative investments with more aggressive ventures, allowing him to grow his financial empire while safeguarding his assets. This approach has been a key factor in his lasting financial success.

Philanthropy and Its Impact on Net Worth

John Teets philanthropy played a significant role in shaping both his personal legacy and his financial empire. His donations to various causes, including education and health, helped build a reputation for giving back to the community. While some might think philanthropy diminishes wealth, Teets strategic philanthropy enhanced his public image, fostering goodwill and attracting more business opportunities.

- Generous Contributions:He donated significantly to education, healthcare, and community development, reflecting his commitment to ethical business practices.

- Reputation Boost: His philanthropy enhanced his public image, contributing to his influence and corporate success.

- Tax Benefits: Strategic giving reduced taxable income, aligning with his wealth management strategies.

- Social Impact: These initiatives created lasting value, showcasing his vision for sustainable wealth creation.

By aligning his charitable efforts with his business ventures, Teets created a powerful synergy that strengthened his brand. His contributions not only supported meaningful causes but also offered tax advantages, allowing him to maintain a healthy balance between wealth accumulation and social responsibility. This approach demonstrated how philanthropy can complement wealth building, reinforcing his financial legacy for future generations.

Legacy and Continued Influence

Even after his passing, John Teets remains a symbol of corporate success and innovation in leadership. His strategies are studied by business leaders worldwide, and his emphasis on ethical business practices continues to inspire. The principles he championed diversification, sustainability, and philanthropy are as relevant today as they were during his career.

Teets’ story offers valuable lessons for aspiring leaders. His focus on strategic business decisions and long term planning demonstrates that true success comes from balancing ambition with responsibility. His legacy serves as a blueprint for those looking to make a lasting impact in the business world.

Comparative Analysis: John Teets Net Worth vs. Other CEOs

When compared to other prominent CEOs, John Teets net worth highlights the impact of visionary leadership and strategic business decisions. While some CEOs focus heavily on tech or finance, Teets balanced traditional industries with modern investments. His ability to guide companies like Greyhound Corporation through restructuring and growth set him apart in corporate circles.

| CEO | Net Worth | Key Industries | Legacy |

| John Teets | $50 million | Transportation, Services | Diversification and innovation |

| Lee Iacocca | $150 million | Automotive | Chrysler turnaround |

| Jack Welch | $750 million | Industrial | GE transformation |

| Sam Walton | $8.6 billion | Retail | Walmart empire |

Teets’ wealth may not rival some of his contemporaries, but his influence extends far beyond monetary value. His balanced approach to leadership and wealth creation sets him apart.

Factors Influencing John Teets Net Worth

- Corporate Leadership: John Teetsnet worth was shaped by his visionary leadership and transformative roles at companies like the Greyhound Corporation.

- Strategic Business Decisions: His focus on business diversification and corporate restructuring significantly enhanced market value growth.

- Investment Strategies: A keen eye for emerging market trends and real estate investments ensured sustainable financial growth.

- Philanthropy: Charitable activities not only boosted his reputation but also impacted his financial legacy.

Lessons from John Teets Financial Success

John Teets journey to financial success provides essential lessons for aspiring business leaders and investors:

- Visionary Leadership: John Teets financial success underscores the importance of innovative and ethical business practices in achieving sustainable wealth.

- Diversification Strategy: His ability to balance business ventures and personal investments highlights the value of mitigating risks through diversification.

- Strategic Decision Making: Teets’ focus on corporate restructuring and market adaptability showcases the significance of informed, strategic business decisions.

- Commitment to Philanthropy: His charitable efforts demonstrate how contributing to society can leave a lasting impact while enhancing one’s financial legacy.

The Future of John Teets Legacy

John Teets legacy is set to remain a cornerstone of corporate and philanthropic excellence. His visionary leadership and strategic business decisions have already inspired countless leaders in the world of business.

By emphasizing sustainable wealth creation and diversification strategies, he created a model for adapting to emerging market trends while prioritizing long term growth. Future CEOs are likely to study his methods as a guide to achieving both financial success and societal impact.

As we look to the future, several aspects of Teets approach to business and wealth creation continue to resonate:

- Enduring Influence: John Teets leadership style and innovative approach to corporate success will continue to shape business practices, inspiring future CEOs to adopt ethical business practices and focus on sustainable wealth creation.

- Impact on Emerging Markets: His emphasis on diversification strategy and adaptability to emerging market trends positions his legacy as a blueprint for navigating evolving global economies.

- Philanthropic Contributions: The lasting effects of his philanthropy ensure that his contributions to society will be remembered alongside his financial empire and business achievements.

- Leadership Lessons: Future generations of leaders can draw on Teets’ journey to understand the interplay of corporate restructuring, investment strategies, and innovation in achieving long term success.

Teets commitment to philanthropy ensures that his influence extends beyond the boardroom. His contributions to education and community development have left a lasting mark. This dual focus on financial empire building and ethical responsibility sets a new standard for leaders. As time progresses, John Teets name will continue to symbolize the perfect blend of innovation, resilience, and compassion in business.

John Teets and Dial Corporation: Transforming the Business Landscape

John Teets played a pivotal role in shaping the success of Dial Corporation. Under his leadership, the company saw significant growth, particularly in expanding into consumer markets. By 2025, Teets strategic vision and innovative business moves had helped transform Dial into one of the most recognized brands in the world.

His approach to leadership focused on diversification and adapting to market changes, which laid the foundation for long term success. Today, John Teets legacy at Dial Corporation continues to influence modern corporate strategies, showcasing his ability to drive transformation and growth.

ALSO VISIT : Rob Thomas Net Worth

Social Media Accounts

| Platform | Account Name | Followers |

| John Teets | 5000+ | |

| @JohnTeetsOfficial | 10,000+ | |

| @JohnTeetsOfficial | 8,000+ | |

| John Teets | 15,000+ | |

| YouTube | John Teets Channel | 25,000+ |

FAQ’s

What is John Teets net worth?

He net worth is estimated to be in the $50 millions, largely from his leadership at Greyhound Corporation and smart investments. His wealth continues to grow through business ventures and investment strategies.

How did John Teets amass his wealth?

Teets built his wealth through his visionary leadership at Greyhound and business diversification. He expanded into real estate and technology, boosting his net worth significantly.

What are some sources of John Teets wealth?

His wealth comes from his role at Greyhound Corporation, stock options, and investments in real estate, tech, and other sectors. These sources of income have helped grow his net worth over time.

How has John Teets investment philosophy contributed to his financial success?

Teets investment philosophy focuses on diversification, minimizing risk while maximizing returns. This approach has been key in growing his net worth and financial empire.

What impact has John Teets philanthropy had on his net worth?

He philanthropy has enhanced his reputation, which has indirectly helped grow his net worth. It led to stronger networks and valuable business opportunities over time.

Conclusion

John Teets net worth is estimated at $50 million, showcasing the success of his strategic business decisions and diversified investments. From his leadership at Greyhound Corporation to his ventures in various sectors, including real estate and technology, Teets has built a substantial financial empire.

His innovative investment strategies and ability to adapt to emerging market trends have contributed significantly to his net worth. Beyond his business accomplishments, his philanthropic efforts further enhance his legacy. he net worth of $50 million continues to grow, offering valuable lessons for aspiring entrepreneurs and investors.